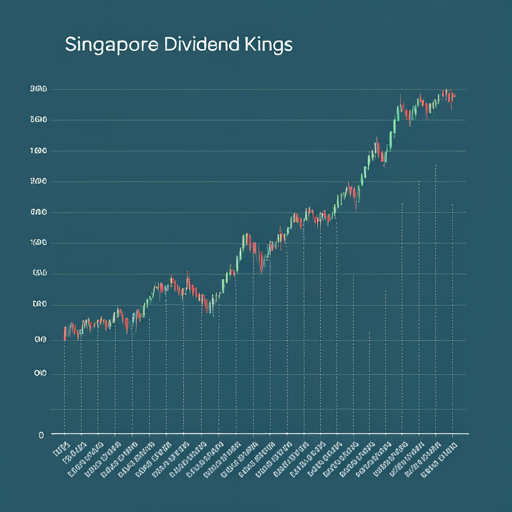

Singapore Dividend Kings for Retirement

- - -

- Oct 8, 2024

- 2 min read

Here are 7 of the top dividend kings in Singapore that you may consider adding to your retirement portfolio:

1. DBS Group Holdings (SGX:D05):

Dividend Yield: 3.5%

Industry: Banking and Financial Services

Description: DBS is the largest bank in Singapore and Southeast Asia, offering a wide range of financial products and services. It has a strong track record of dividend payments and a diversified business model.

2. United Overseas Bank Ltd (SGX:U11):

Dividend Yield: 3.5%

Industry: Banking and Financial Services

Description: UOB is another major bank in Singapore, with a focus on providing personalized banking solutions. It has a strong capital position and a history of consistent dividend growth.

3. Oversea-Chinese Banking Corporation (SGX:O39):

Dividend Yield: 3.5%

Industry: Banking and Financial Services

Description: OCBC is the third-largest bank in Singapore, with a focus on wealth management and treasury services. It has a strong regional presence and a track record of stable dividend payments.

4. Singapore Telecommunications (SGX:Z74):

Dividend Yield: 4.5%

Industry: Telecommunications

Description: Singtel is Singapore's largest telecommunications company, offering a wide range of services including mobile, broadband, and pay TV. It has a strong cash flow generation and a history of consistent dividend payments.

5. ST Engineering (SGX:S63):

Dividend Yield: 3.5%

Industry: Engineering and Technology

Description: ST Engineering is a global technology, defence, and marine engineering group. It has a diversified portfolio of businesses and a strong track record of profitability.

6. Keppel Corporation (SGX:BN4):

Dividend Yield: 3.5%

Industry: Offshore and Marine

Description: Keppel is a leading provider of offshore and marine engineering solutions. It has a strong global presence and a history of stable dividend payments.

7. CapitaLand Investment Limited (SGX:9CI):

Dividend Yield: 3.5%

Industry: Real Estate

Description: CapitaLand Investment is a leading integrated real estate developer and manager. It has a diversified portfolio of properties and a strong track record of dividend payments.

Important Considerations:

Dividend Yield: While dividend yield is an important factor to consider, it's not the only factor. You should also consider the company's financial health, growth prospects, and overall risk profile.

Diversification: It's important to diversify your retirement portfolio across different asset classes and sectors to manage risk.

Regular Review: Regularly review your investment portfolio and make adjustments as needed to ensure it aligns with your retirement goals.

Comments